Best Practices for Avoiding Student Loan Scams

Protect yourself from fraud with best practices for avoiding student loan scams. Stay vigilant and secure your financial information.

Protect yourself from fraud with best practices for avoiding student loan scams. Stay vigilant and secure your financial information.

Best Practices for Avoiding Student Loan Scams

Hey everyone! Let's talk about something super important for all of us navigating the world of student loans: avoiding scams. It's a jungle out there, and unfortunately, there are a lot of bad actors trying to take advantage of students and graduates. These scams can range from identity theft to outright stealing your money. But don't worry, with a little knowledge and some smart practices, you can protect yourself and your hard-earned cash. We're going to dive deep into what these scams look like, how to spot them, and most importantly, how to steer clear. We'll also look at some specific tools and resources that can help you stay safe.

Understanding Common Student Loan Scams and Fraudulent Practices

First things first, let's get familiar with the types of scams you might encounter. Knowing what to look for is half the battle. Scammers are constantly evolving their tactics, but many common themes persist. They often prey on desperation, confusion, or a lack of information. They might promise quick fixes, guaranteed loan forgiveness, or exclusive deals that sound too good to be true – because they usually are.

Phishing and Impersonation Scams Targeting Student Loan Borrowers

This is a big one. Phishing scams involve fraudsters pretending to be legitimate organizations like your loan servicer, the Department of Education, or even a government agency. They'll send you emails, texts, or even make phone calls that look and sound official. The goal? To trick you into revealing personal information like your Social Security number, bank account details, or loan account credentials. They might ask you to click on a suspicious link that leads to a fake website designed to steal your login info. Always be wary of unsolicited communications asking for sensitive data. Legitimate organizations will rarely ask for this information via email or text.

Student Loan Debt Relief Scams and Forgiveness Promises

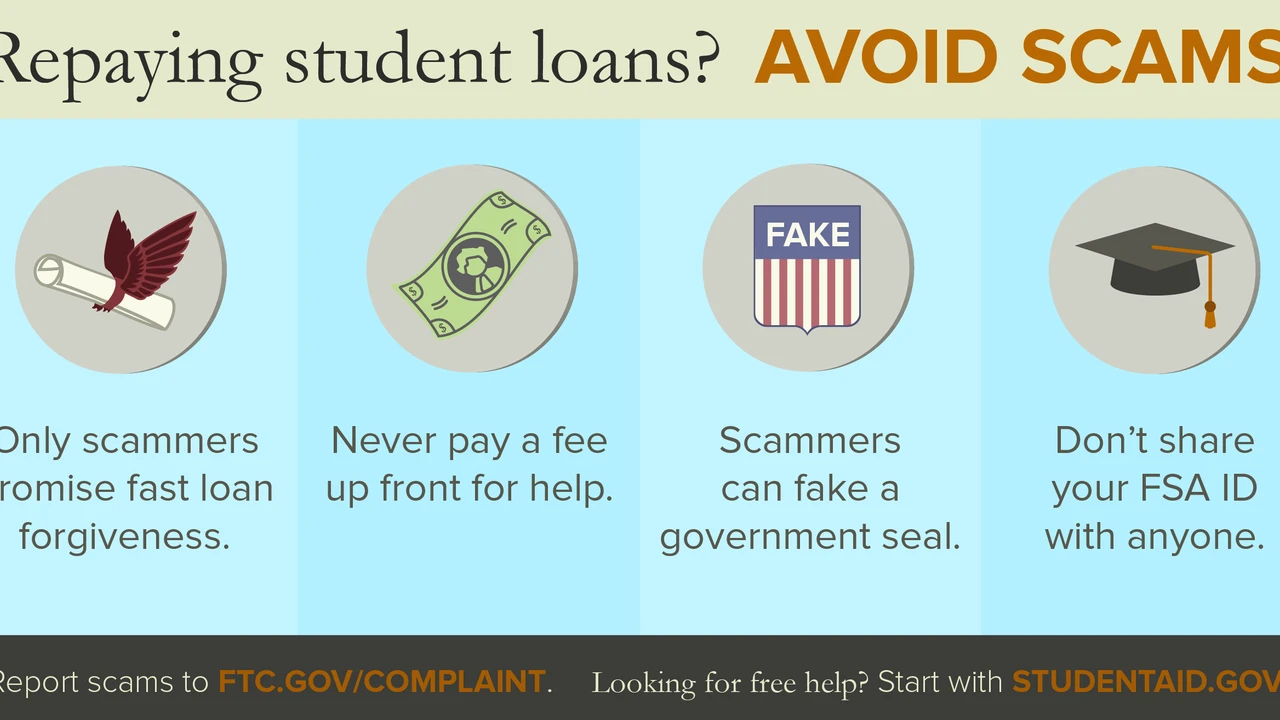

With all the talk about student loan forgiveness and relief programs, this area is ripe for scams. Fraudsters will promise guaranteed loan forgiveness, immediate debt cancellation, or significantly reduced payments in exchange for an upfront fee. They might claim to have special access to government programs or a secret loophole. Remember, legitimate government programs for loan forgiveness or relief never charge an upfront fee. If someone asks you to pay to apply for forgiveness, it's a scam. They might also try to get you to sign over power of attorney, which gives them control over your loan accounts.

Identity Theft and Unauthorized Access to Student Loan Accounts

This is perhaps the most damaging type of scam. Identity theft can occur if scammers gain access to your personal information, which they can then use to open new lines of credit, access your existing loan accounts, or even file fraudulent tax returns. They might try to trick you into giving them your login credentials for your loan servicer's website. Always use strong, unique passwords for all your financial accounts and enable two-factor authentication whenever possible. Regularly check your credit report for any suspicious activity.

Advance Fee Loan Scams and Upfront Payment Traps

These scams involve fraudsters promising to help you consolidate your loans, lower your interest rates, or get you a new loan, but only if you pay an upfront fee. Once you pay, they disappear, and you never hear from them again. Legitimate lenders and loan servicers do not charge upfront fees for these services. Any company asking for money before providing a service related to your student loans should raise a huge red flag.

Identifying Red Flags and Suspicious Behavior in Student Loan Communications

Now that we know the types of scams, let's talk about how to spot them. It's all about recognizing the red flags. Think of yourself as a detective, always looking for clues that something isn't quite right.

Unsolicited Contact and Pressure Tactics from Unknown Entities

Did you get an email or call out of the blue about your student loans? Be suspicious. Scammers often initiate contact, sometimes even claiming to be from a government agency or your loan servicer. They might use high-pressure tactics, urging you to act immediately or risk losing out on a special offer. Legitimate organizations will give you time to review information and make decisions. If they're pushing you to act fast, it's a warning sign.

Requests for Personal Information and Financial Details

This is a huge red flag. Never provide your Social Security number, bank account details, credit card numbers, or loan account login information to anyone who contacts you unsolicited. If you receive a request for this information, even if it looks legitimate, contact your loan servicer directly using a verified phone number or website (not one provided in the suspicious communication) to confirm its authenticity.

Promises of Guaranteed Loan Forgiveness or Immediate Debt Relief

As we discussed, if it sounds too good to be true, it probably is. No legitimate entity can guarantee loan forgiveness or immediate debt relief for a fee. Loan forgiveness programs have specific eligibility requirements, and the process is handled directly by the Department of Education or your loan servicer. Be extremely skeptical of anyone promising a quick fix to your student loan debt.

Unusual Payment Methods and Upfront Fees for Services

Scammers often ask for payment via unusual methods like gift cards, wire transfers, or cryptocurrency, which are difficult to trace. They also, as mentioned, demand upfront fees for services that should be free or are paid after the service is rendered. Legitimate loan servicers and government agencies will never ask for payment in these ways or for upfront fees for loan relief programs.

Grammar Errors and Unprofessional Communication Styles

Believe it or not, even small details can give away a scam. Look for poor grammar, spelling mistakes, awkward phrasing, or an unprofessional tone in emails or letters. While not always a definitive sign, these errors are common in scam communications and are rarely found in official correspondence from legitimate financial institutions or government agencies.

Essential Steps to Protect Yourself from Student Loan Scams

Okay, so you know what to look for. Now, let's talk about proactive steps you can take to protect yourself. These are your best defenses against falling victim to a scam.

Verify the Identity of Senders and Callers Before Sharing Information

Always, always, always verify. If you receive a suspicious email or phone call, do not respond directly. Instead, independently look up the official contact information for your loan servicer or the Department of Education (e.g., on their official websites) and contact them directly to inquire about the communication. Never use phone numbers or links provided in the suspicious message itself. A quick search for the official website will save you a lot of headaches.

Never Pay Upfront Fees for Student Loan Assistance or Forgiveness

This is a golden rule: legitimate student loan assistance and forgiveness programs do not charge upfront fees. If a company asks for money before they provide any service, especially for something like loan forgiveness or consolidation, it's a scam. Period. You can apply for federal loan programs directly through the Department of Education for free.

Utilize Official Government and Loan Servicer Websites for Information

When you need information about your student loans, always go directly to the source. For federal student loans, the official website is studentaid.gov. For your specific loans, log in directly to your loan servicer's official website. Bookmark these sites to avoid accidentally landing on a fake one. These sites are secure and provide accurate, up-to-date information.

Regularly Monitor Your Credit Report and Financial Accounts

Keep a close eye on your financial health. You can get a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year at annualcreditreport.com. Check for any accounts you don't recognize or suspicious inquiries. Also, regularly review your bank statements and student loan account activity for any unauthorized transactions. Many banks and loan servicers offer alerts for unusual activity, so enable those if available.

Report Suspected Scams to Relevant Authorities and Agencies

If you encounter a scam, report it! This helps protect others and provides valuable information to law enforcement. You can report scams to the Federal Trade Commission (FTC) at reportfraud.ftc.gov, the Consumer Financial Protection Bureau (CFPB), and your state's Attorney General's office. If it involves federal student loans, you can also report it to the Department of Education's Office of Inspector General.

Recommended Tools and Resources for Student Loan Security

Beyond general best practices, there are specific tools and resources that can significantly enhance your security. Think of these as your digital bodyguards.

Credit Monitoring Services and Identity Theft Protection

While you can manually check your credit report, credit monitoring services can do it for you automatically and alert you to any suspicious activity. Many banks and credit card companies offer free credit monitoring as a perk. For more comprehensive protection, consider services like:

- IdentityGuard: Offers comprehensive identity theft protection, including credit monitoring, dark web monitoring, and identity restoration services. They have different plans, with prices typically ranging from $7.50 to $25 per month, depending on the level of coverage.

- LifeLock (by Norton): A well-known name in identity theft protection, LifeLock provides credit monitoring, identity alerts, and restoration services. Their plans usually start around $9.99 per month for basic coverage and go up for more extensive features.

- Experian IdentityWorks: Directly from one of the major credit bureaus, this service offers credit monitoring, FICO score tracking, and identity theft insurance. They have free and paid tiers, with paid plans starting around $9.99 per month.

Usage Scenario: These services are great for anyone who wants peace of mind and immediate alerts if their personal information is compromised or if new accounts are opened in their name. They're particularly useful if you've ever been a victim of a data breach.

Password Managers and Two-Factor Authentication (2FA) Apps

Strong, unique passwords are your first line of defense. A password manager helps you create and store them securely. Two-factor authentication adds an extra layer of security by requiring a second verification step (like a code from your phone) in addition to your password.

- LastPass: A popular password manager that securely stores your passwords, generates strong new ones, and can auto-fill login forms. It has a free tier for basic use and premium plans starting around $3 per month for more features like dark web monitoring.

- 1Password: Another highly-rated password manager known for its robust security features and user-friendly interface. It offers family and business plans, with individual plans starting around $2.99 per month.

- Google Authenticator / Microsoft Authenticator: These are free apps that generate time-based one-time passwords (TOTP) for 2FA. They're simple to use and compatible with most services that offer 2FA.

Usage Scenario: Use a password manager for all your online accounts, especially financial ones. Enable 2FA on your student loan servicer's website, your bank accounts, and any other sensitive online services. This makes it much harder for scammers to gain unauthorized access, even if they somehow get your password.

Secure Communication Channels and Official Contact Information Verification

Always use secure and verified channels when communicating about your student loans. This means avoiding public Wi-Fi for sensitive transactions and always double-checking contact information.

- Official Websites: Always type in the URL for your loan servicer or studentaid.gov directly into your browser. Do not click on links from suspicious emails or texts.

- Secure Messaging Portals: Most loan servicers have secure messaging portals within your online account. Use these for sensitive communications rather than email.

- Verified Phone Numbers: If you need to call your loan servicer, find their official phone number on their website, not from an email or a quick Google search that might lead to a scammer's number.

Usage Scenario: Before making any payment or sharing any information, ensure you are on a legitimate, secure website (look for 'https://' and a padlock icon in the URL bar). If in doubt, call the official number you've independently verified.

Antivirus Software and Malware Protection for Devices

Your devices can be a gateway for scammers. Antivirus and anti-malware software can protect you from malicious programs that might try to steal your information.

- Norton 360: A comprehensive security suite that includes antivirus, anti-malware, VPN, and dark web monitoring. Various plans are available, often starting around $30-$50 for the first year.

- Bitdefender Total Security: Highly rated for its protection against various threats, including ransomware and phishing. It offers multi-device protection and usually costs around $40-$60 for a yearly subscription.

- Malwarebytes: Excellent for detecting and removing malware that traditional antivirus might miss. They offer a free scanner and premium versions starting around $30 per year.

Usage Scenario: Install reputable antivirus and anti-malware software on your computer and smartphone. Keep it updated and run regular scans. This helps prevent keyloggers or other malicious software from capturing your sensitive financial information.

Real-Life Examples of Student Loan Scams and Their Consequences

It's one thing to talk about scams in theory, but seeing real-life examples can really drive the point home. These stories highlight how cunning scammers can be and the devastating impact their actions can have.

The "Guaranteed Forgiveness" Phone Call Scam

Imagine Sarah, a recent graduate drowning in student loan debt. She receives a call from someone claiming to be from a "Student Loan Forgiveness Department." The caller sounds official, knows her name, and even some details about her loans (likely from a data breach). They tell her she qualifies for a new, limited-time government program that will forgive 80% of her debt, but she needs to pay a $500 "processing fee" immediately to secure her spot. They pressure her, saying the offer expires in 24 hours. Desperate for relief, Sarah pays the fee via a wire transfer. The "department" then disappears, and Sarah's loans remain, now with an extra $500 gone. This scam preys on urgency and the desire for a quick fix.

The Phishing Email Impersonating a Loan Servicer

John gets an email that looks exactly like it's from his loan servicer, complete with their logo and official-looking language. The subject line reads, "Urgent: Your Student Loan Account is on Hold." The email states there's an issue with his payment and he needs to click a link to update his information. John, worried about his credit, clicks the link. It takes him to a website that looks identical to his loan servicer's login page. He enters his username and password. Unbeknownst to him, he's just given his login credentials directly to scammers. They then log into his real account, change his contact information, and attempt to redirect payments or even apply for new loans in his name. This scam relies on creating a sense of urgency and mimicking legitimate websites.

The "Debt Consolidation" Advance Fee Scheme

Maria is struggling with multiple student loans and high interest rates. She sees an online ad for a company promising to consolidate all her loans into one low-interest payment, saving her thousands. When she calls, a friendly representative explains their "exclusive" program, but says she needs to pay a $1,000 "enrollment fee" upfront to cover administrative costs. They assure her the savings will far outweigh this fee. Maria, seeing the potential for relief, pays the fee. After a few weeks of no communication, she tries to call them back, but the phone number is disconnected, and their website is gone. The company was a shell, designed only to collect upfront fees. Maria is left with her original loans and $1,000 less in her bank account. This scam exploits the desire for financial simplification and lower payments.

The Identity Theft Through Public Wi-Fi Scam

David is studying at a coffee shop using public Wi-Fi. He decides to check his student loan balance and makes a payment. Unbeknownst to him, a scammer on the same network has set up a fake Wi-Fi hotspot that looks legitimate (e.g., "CoffeeShop_Free_WiFi"). When David connects, the scammer intercepts his data, including his login credentials for his loan servicer. With this information, the scammer gains access to David's account, changes his address, and applies for a new loan in his name, diverting the funds to their own account. This highlights the importance of using secure networks and a VPN when handling sensitive information on public Wi-Fi.

Staying Informed and Proactive Against Evolving Scams

The world of scams is constantly changing, so staying informed is crucial. Scammers are always looking for new angles and new ways to exploit vulnerabilities. By keeping up-to-date on the latest scam alerts and financial security best practices, you can stay one step ahead.

Subscribing to Official Alerts and Consumer Protection Newsletters

Many government agencies and consumer protection organizations offer free newsletters and alerts about new scams. Subscribing to these can give you a heads-up on emerging threats. For example, the Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) regularly publish warnings about financial scams, including those related to student loans. Your loan servicer might also send out alerts about common scams they're seeing.

Participating in Financial Literacy Workshops and Webinars

Many universities, non-profit organizations, and financial institutions offer free workshops or webinars on financial literacy, including topics like debt management and scam prevention. These can be a great way to learn from experts and ask questions in a safe environment. Knowledge is power, and the more you understand about your finances and potential risks, the better equipped you'll be to protect yourself.

Engaging with Reputable Online Communities and Forums for Advice

While you should always be cautious about advice from unverified sources, reputable online communities and forums (like those on Reddit dedicated to personal finance or student loans) can be good places to hear about others' experiences with scams and get general advice. Just remember to cross-reference any specific advice with official sources before acting on it. Look for communities moderated by financial professionals or those with a strong track record of providing accurate information.

Regularly Reviewing and Updating Your Security Practices

Security isn't a one-time setup; it's an ongoing process. Regularly review your passwords, check your privacy settings on social media and other online accounts, and ensure your antivirus software is up-to-date. Consider changing your passwords periodically, especially for your most sensitive accounts. The digital landscape changes rapidly, and so should your security habits.

Trusting Your Gut and Seeking Second Opinions

Finally, and perhaps most importantly, trust your instincts. If something feels off, it probably is. If a deal seems too good to be true, it almost certainly is. Don't be afraid to ask questions, do your own research, and seek a second opinion from a trusted friend, family member, or financial advisor before making any decisions related to your student loans, especially if money or personal information is involved. A moment of caution can save you from a lifetime of regret.

Navigating student loans can be stressful enough without the added worry of scams. By being informed, vigilant, and proactive, you can significantly reduce your risk of falling victim to these fraudulent schemes. Stay safe out there, and remember, your financial security is in your hands!

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)